Landlords – Are you covered?

With the rise in property being rented out, the thought of not having appropriate cover can be a worry that is something we could all do without.

we will do it together

At Needham Insurance, we pride ourselves in providing you with the best and more cost effective cover you need. We have access to many policies and compare so that you do not have to. Our comprehensive knowledge in all insurance fields means that we will be able to help you every step of the way.

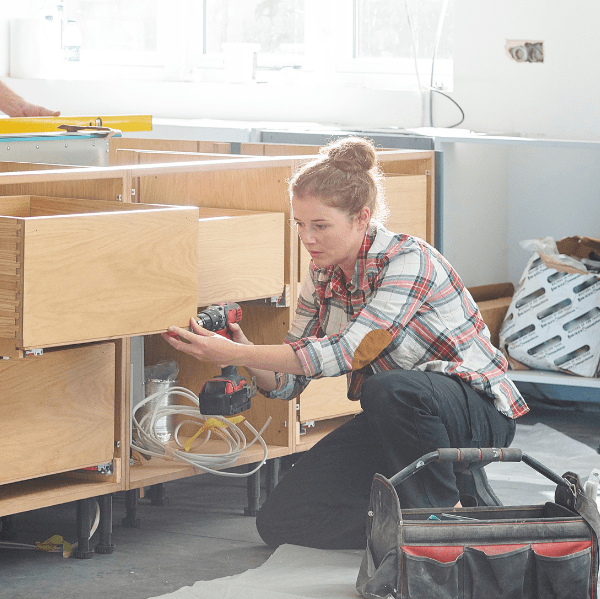

An Insurance Backed Guarantee (IBG) is a guarantee given by a contractor to provide peace of mind in case the contractor has ceased trading.

An IBG is protection for both you and your customers, in the unlikely event of your company ceasing to trade.

An Insurance Backed Guarantee raises a customer’s confidence, should your business close your insurer will honour any claims under the original guarantee.

Alexander Graham Bell

Cover is usually for up to 10 years and is highlighted in contracts, but other periods are available upon request and any kind of work can be covered in an Insurance Backed Guarantee.

At Needham Insurance, we have specialists that can provide you with the help and support to ensure that you have the right cover, meaning that contractors can meet deadlines and contracts.

Click on the link below and complete the enquiry form today

An Insurance Backed Guarantee does exactly what it says, it Backs Up a Guarantee that is already in force. It really is that simple, a contractor issues a Guarantee for their Workmanship and Products and we will back that Guarantee up with an Insurance Policy ensuring the customer has someone to call to rectify any issues if the Contractor is no longer trading.

Sets the contractors apart from competitors that cannot offer such a guarantee and demonstrates the quality of, and confidence in, the contractors’ product and workmanship.

Enables the contractor to submit and win tenders on contracts where insurance backed guarantees are a requirement.

Demonstrates the fact that the contractor has satisfied insurers as to the quality of their work.

Provides vital protection and security for the building owner and their funder.

Contractors, large and small, cease to trade each year for a multitude of different reasons. Guarantee periods can vary from 2 years to 10 years and much can happen to any business in that time, regardless of current stature.

If your chosen installer were to cease trading you could be left with faulty goods, a guarantee of no value and a potential bill to rectify any problem.

With the rise in property being rented out, the thought of not having appropriate cover can be a worry that is something we could all do without.